34,574 reads

Portfolio Management: All The Ways AI Is Transforming Modern Asset Strategies

by Andrey KustarevApril 25th, 2024

Too Long; Didn't Read

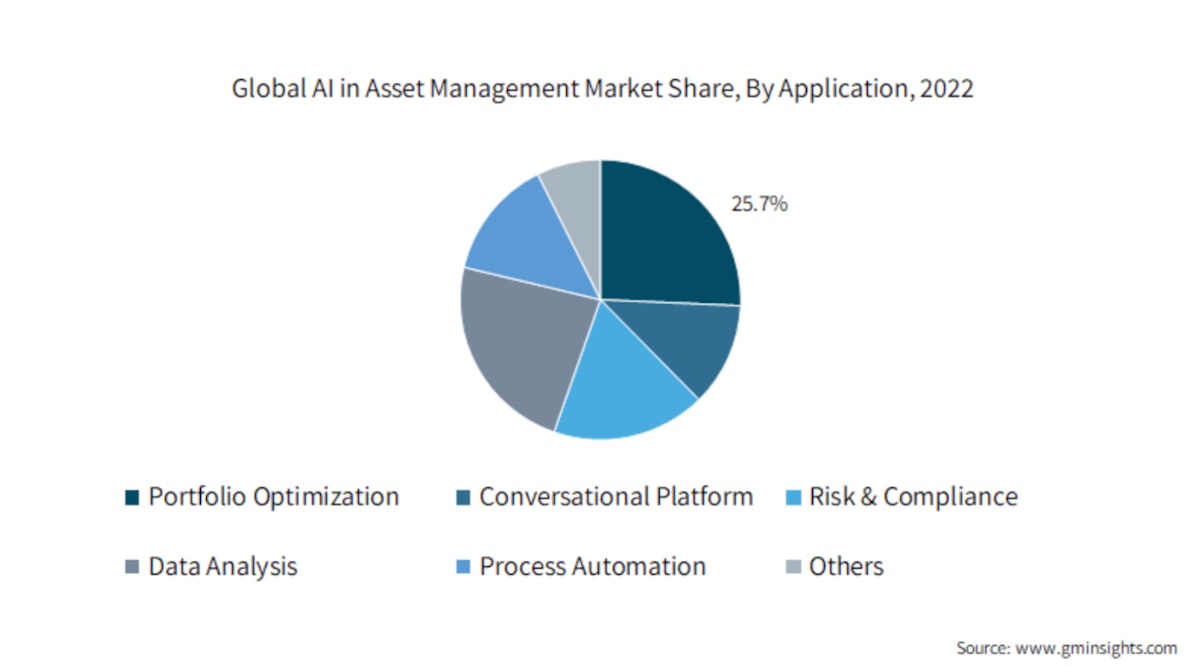

The rise of AI has significantly impacted various industries, and the finance industry is among those most affected. In recent decades, AI has been implemented in different sectors of the finance industry. In the back office, ML algorithms are used to find anomalies in execution logs, detect suspicious transactions, and manage risks, leading to increased efficiency and security. In the front office, AI helps segment customers, automate customer support processes, and optimize derivatives pricing. However, the most intriguing aspect is AI's capabilities for the buy-side of finance — identifying predictive signals amid market noise by analyzing significant amounts of data as quickly as possible. Fields of application for AI include portfolio optimization, fundamental analysis, textual analysis, trading activities, investment advisory services, risk management, etc. Examples of implemented techniques and tools are machine learning algorithms, natural language processing, quantitative trading strategies, and explainable AI (XAI), among others.L O A D I N G

. . . comments & more!

. . . comments & more!